Crimes Against Humanity and War Crimes Act (S.C. 2000, c. 24) [Link]

January 27th, 2024

Uncashable Check & Record Omissions

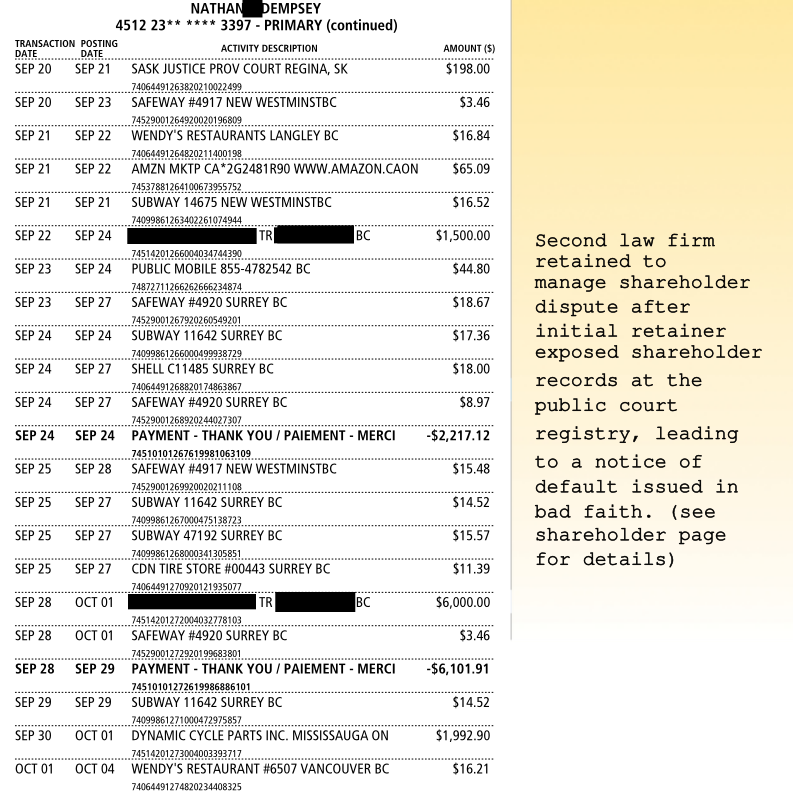

Supplemental to the Litigation account regarding the close of the initial shareholder oppression matter with the CAGE entity, a series of information pieces should be cited. These in their own right may have no material relevance if understood as isolated events, but may nonetheless be meaningful in the course of an investigation. In October 2021, the second law firm I had retained (following an act of gross negligence by the first), had written-off milestone events concerning the close of the settlement in their service record. I was provided with a separate "written-off" statement which listed the close of the dispute and payout after three weeks of follow-up. This included follow-ups with TD Bank, whereas the trust check provided by counsel for the CAGE Entity was unable to be cashed and deposited. According to counsel, a keying error at a local TD branch required three weeks to resolve.

Disposition of Shares Listed as Dividend Payment

CAGE Entity T-5 [2021]

The disposition of shares resulting from the original dispute was reflected in a T-5 filing as a dividend payment, and not as a securities transaction. As is the case with any securities transaction or change of ownership, a T-5008 statement must accompany the T-5. Although these statements may show overlapping figures, both must be issued, and filed at the Canada Revenue Agency ("CRA"). The purpose is to provide CRA with insight into what the figures actually mean in an event they get audited. A T-5 denoting a dividend amount was the only CRA statement issued by the CAGE entity.

Obligation to Record & File Securities Transaction

In observing this, I note that the governing Shareholder Agreement I received from the CAGE Entity is materially different than the Agreement used for other shareholders (pages 98-110, 123-125, and 137 in the redacted November 22nd, 2023 Affidavit), and whereas, the CAGE entity's FY2020 fiscal policy derecognized share transfers (page 121). The original Share Transfer and Power of Attorney is listed on page 108. The March 2021 dividend payment referenced by the CAGE entity's financial controller was issued through the CAGE Director's personal gmail account.

CAGE Entity Omitted T-5008 From Tax Filing

The CAGE Entity cited the CRA's Qualified Small Business Corporation Shares rule in refusing to file a T-5008 statement. As is denoted in the adjacent post, and as underlined, this rule does not absolve the CAGE Entity of their responsibility to file the T-5008. Notwithstanding, the CAGE Entity maintained its position regarding the T-5008, and did not file one.

Unauthorized Disbursals & Hacks

Unauthorized Disbursals & Hacks (?)

Supplemental to the Zersetzung accounts, sophisticated harassment has not been limited to cyber attacks, break-ins, stalking, and ongoing online harassment. A number of events have occurred over the past two years that are not characteristically germane to the security most banking institutions afford clients. Amid the context of disruptive Zersetzung events germane to this scandal, it is prudent to catalogue outliers such as these in an event they might be relevant in an investigation. The adjacent images depict online chat with a european bank. The account below concerns an unaware and unauthorized disbursal of an RRSP savings account, to a new living address which the bank did not have on file.

_PNG.png)

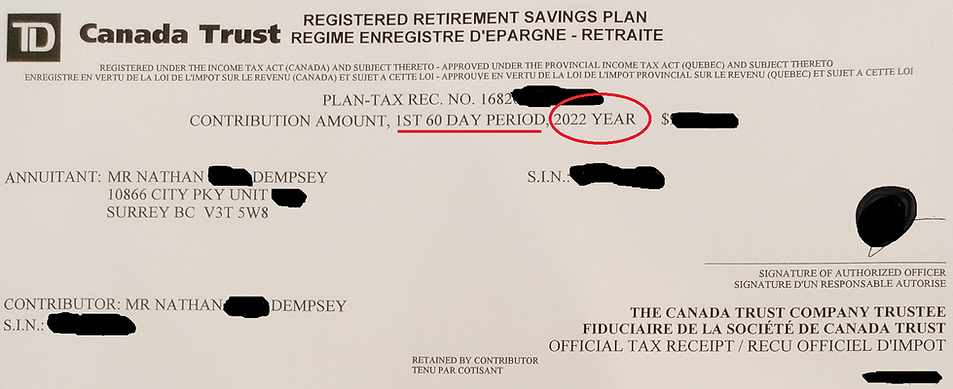

Ambiguous RRSP Tax Receipt

Tax Year, or

Calendar Year?

No execution date.

Of Noteworthy Mention

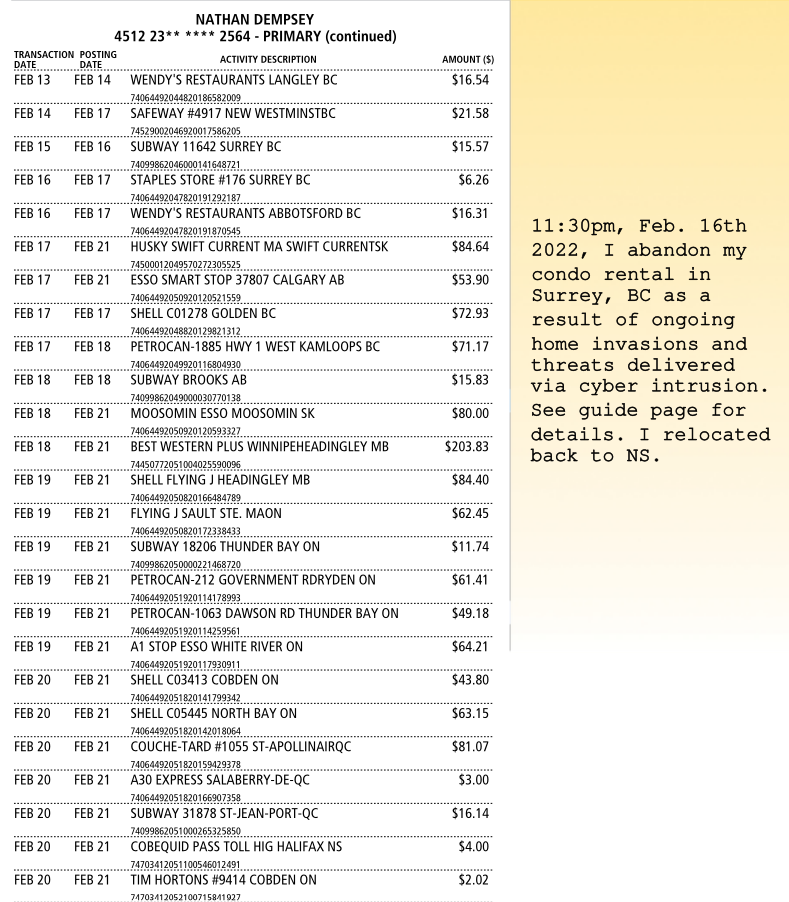

On February 7th, 2022 at 10:30am, I visited a nearby TD bank branch in Surrey, BC to file an RRSP contribution. At that time the branch was empty, with several staff members visibly idle. On informing of my intention, I was advised I could return that same day at 3pm to complete a deposit. Upon my return, I was told that a 12-month RRSP GIC option was unavailable, and whereas the minimum term I could sign for was 14 months. I agreed to the 14-month term and completed the deposit. An hour later, the same branch called and advised that my RRSP contribution slip was not included in the folder I received, and requested that I return to the branch to retrieve it. A different account rep handed me the receipt as shown above. As depicted, the receipt is undated, and can appear ambiguous to uninformed readers. If "1st 60 DAY PERIOD, 2022 YEAR" is read as the 2022 tax year, this would reflect that a contribution was made between January 1st and March 1st, 2023. I took note that I was unable to find another RRSP tax receipt that lacked a date, or displayed an ambiguous filing declaration, with a few examples pictured below. On making this known to the TD rep, I was unable to receive immediate confirmation that a tax deduction had in fact been completed for the 2021 tax year. It took three weeks to secure a written confirmation from TD, whereas by that time, I had relocated to Nova Scotia. An immediate relocation on February 16th, 2022 was necessary following a series of home invasions and death threats delivered via remote PC intrusion, in the absence of help from local RCMP. These events as well as the ongoing disruptive events originating in late November 2021, are listed in the Testimony, Zersetzung, and Litigation pages.

TD Escalated the CRA Receipt

A branch manager advised the undated slip was system-generated, but advised that the materials merited escalation. TD provided confirmation of the execution date in late February 2022.

A Computer-Assisted Audit on the TD RSP Slip Corroborates These Concerns.

Neurotech Scandal 2021 & 2022 Road Trip Records. See Testimony Page For Context [Here]

Event captures like this require AI-Assisted 4IR tools. Ongoing real-time or near-real-time surveillance accompanied by harassment had pre-dated the proceedings and is suffused throughout. It became evident midway through 2022 that my biometric data was (and is) available to bad actors in the dark web. This concerns interests beyond the CAGE.

As above, per the fabricated HRP report that was fed to EHS. Actual event details at the HRP Page (Here).